protecting homeowners with IoT innovation

VYRD was created to serve the challenging Florida homeowners insurance market, and they partnered with Supercharge to rapidly build a market-ready portal to service customers in time for hurricane season.

VYRD was created to serve the challenging Florida homeowners insurance market, and they partnered with Supercharge to rapidly build a market-ready portal to service customers in time for hurricane season.

The homeowners insurance market in Florida is notoriously difficult for carriers to service. High incidents of fraud and high operating costs have stifled business - causing property insurance companies to cancel policies, leave the state, and liquidate at an increasing pace.

Through a joint partnership, SiriusPoint and Bolttech launched VYRD, a digitally-enabled Florida Homeowners Insurance carrier, the first Florida-domiciled Property and Casualty insurer licensed in the state in over three years.

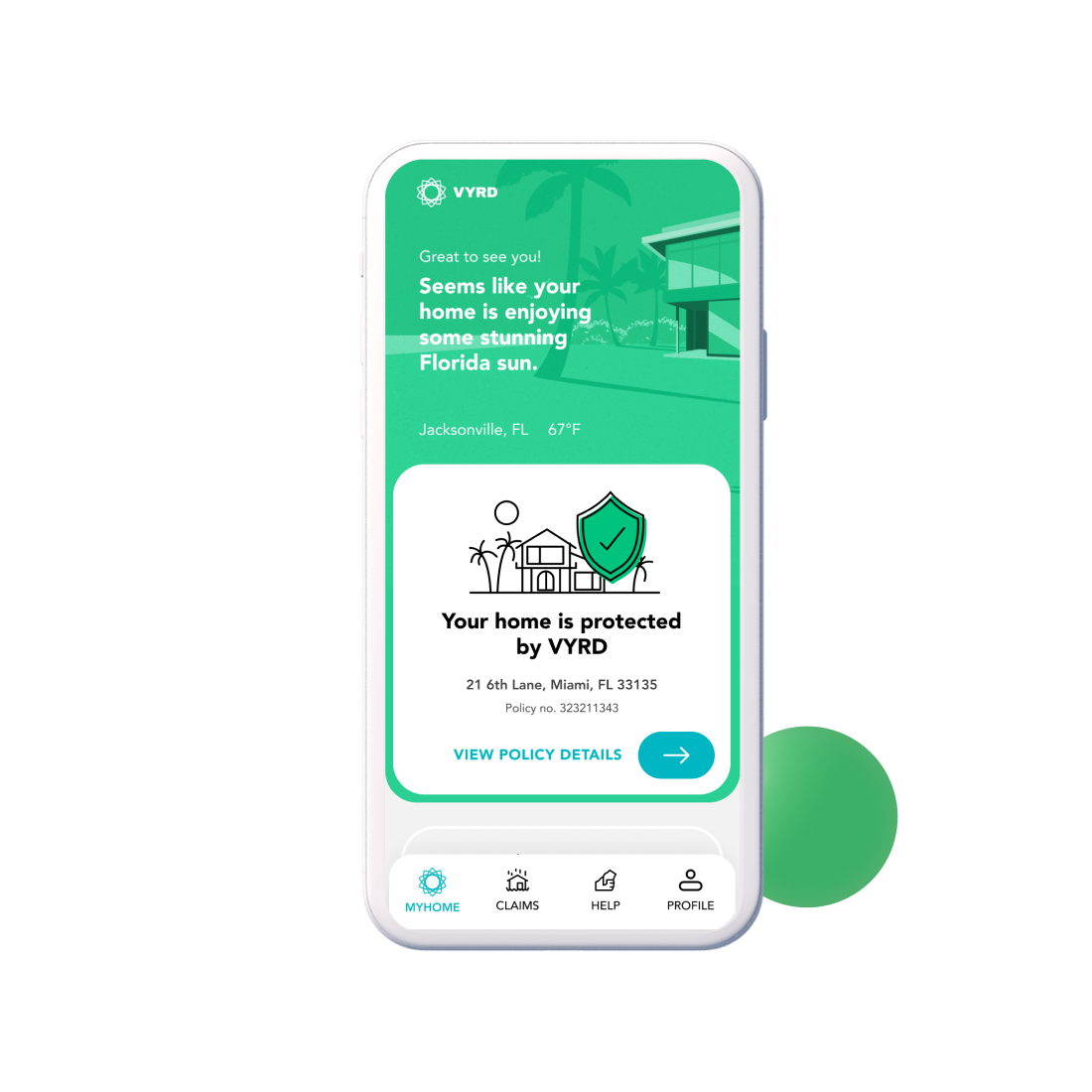

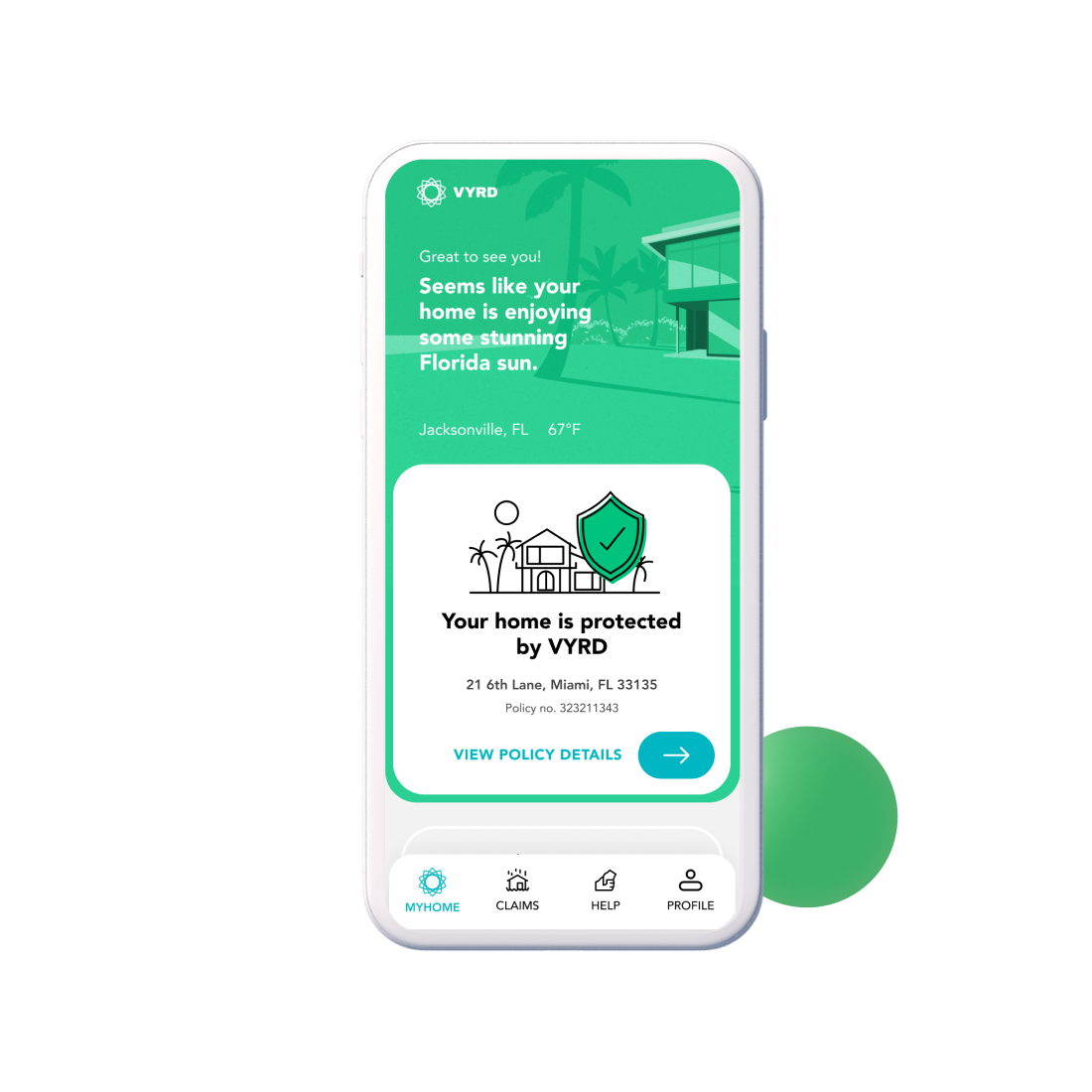

VYRD set out to build a top-tier digital experience, offering IoT features like smart home monitoring to safeguard customers' property and prevent claims. We helped develop an intuitive self-service portal, devised a multi-provider IoT device strategy, and established a centralized data warehouse for automated reporting, all while paving the way for future AI advancements.

As a business, VYRD strikes an important balance between being insurance domain experts and forward looking tech innovators.

VYRD’s focus on speed to market complemented Supercharge’s rapid delivery model — together we created a desperately needed option for Florida residents who have experienced increasing cost and decreasing choice for protecting their homes.

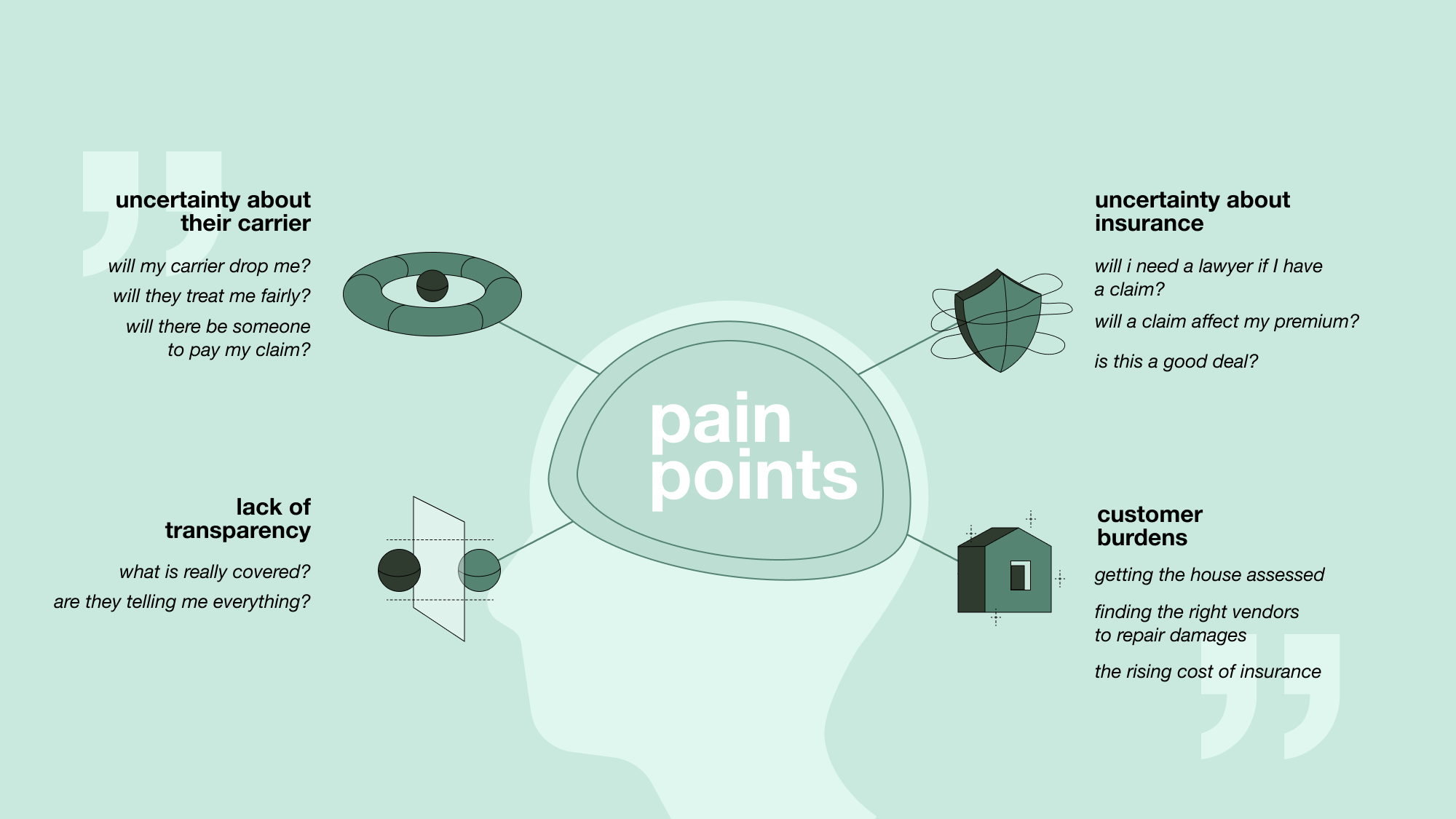

Customers frequently mistrust insurance carriers, and this is especially true in Florida, where dropping coverage has become regular and insurance-focused lawsuits are more common than anywhere else in the country.

VYRD and Supercharge collaboratively conducted qualitative research with Florida homeowners to better understand their perceptions, experiences, and needs related to insurance.

We uncovered pain points, functional needs, and emotional needs to ground our product decisions in their real-world context.

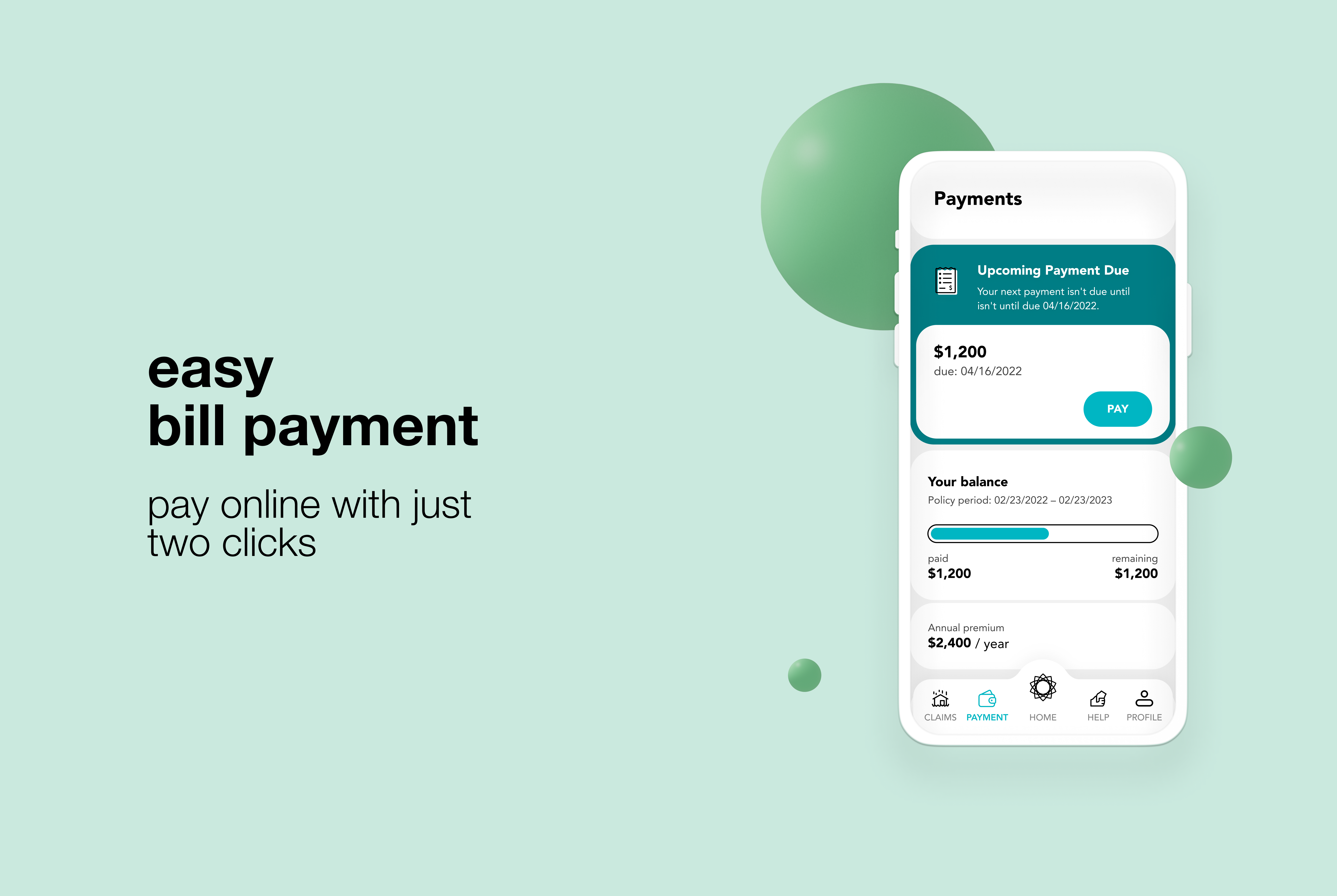

The centerpiece of our work with VYRD was an intuitive, thoughtfully designed customer self service portal that required a complex set of 3rd party integrations to accelerate enrollment, simplify bill paying, and streamline the claims process.

The experience had to provide simplicity and transparency to encourage trust and utility with Florida homeowners.

In addition to the core integrations with their policy admin system, third party claims administrators, payment providers, etc., VYRD created an opt-in IoT device program - providing water detection sensors to customers for their homes.

Through this partnership, VYRD customers can sign up to receive free water sensors and are guided through the installation process.

The ultimate vision is to mitigate costly damages down the line, reducing claim volume and severity for non-catastrophic damage.

Additionally, better communication within the claims journey allows us to recommend preferred vendors at the time of need, an important aspect of reducing potential fraud that is originated by untrustworthy vendors.

When there is a leak detected, customers are immediately notified and can request assistance or even have VYRD send out a team to mitigate the issue.

We built the foundations of the sensor program in our first release of the app, with an eye toward continued IoT expansion to areas like remote water shutoff and further automating claims.

The idea itself is not new: many companies on the market offer leak sensors, pipe-freeze detectors, and shut-off valves.

VYRD goes beyond promoting and distributing IoT devices with their own proprietary data processing and mitigation platform.

For this, we built a centralized data warehouse to clean and combine data sources (policy admin, claims, IoT sensor, web experience) that automates KPI reporting and enables contextual customer communications.

By implementing this solution, VYRD is the first to be informed about any incident, delivering a range of business benefits as a result:

Through our partnership with VYRD, we were able to rapidly spin up the customer self service portal in time to serve customers affected by Hurricane Ian - and we’re continuing to onboard new customers and drive VYRD’s expansion into new territories throughout Florida. We’re excited to deepen our partnership and continue to enhance VYRD’s digital expertise over time.